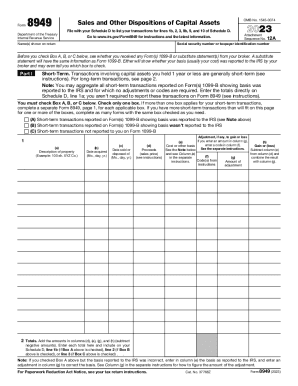

IRS 8949 2024-2025 free printable template

Show details

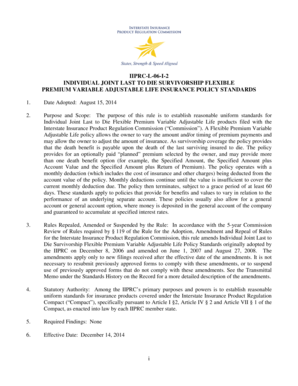

You must check Box A B or C below. Check only one box. If more than one box applies for your short-term transactions complete a separate Form 8949 page 1 for each applicable box. Cat. No. 37768Z Form 8949 2024 Attachment Sequence No. 12A Page 2 Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term see to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line 8a you aren t required to report these...

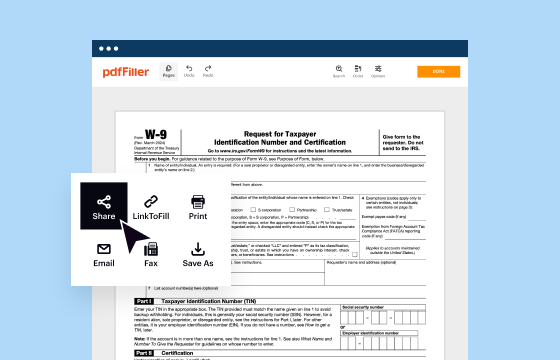

pdfFiller is not affiliated with IRS

Understanding and Effectively Using IRS Form 8949

Detailed Instructions for Editing IRS Form 8949

Guidelines for Completing IRS Form 8949

Understanding and Effectively Using IRS Form 8949

IRS Form 8949 is essential for taxpayers who are reporting capital gains and losses from the sale of assets such as stocks, bonds, or real estate. This form allows individuals to detail each transaction that impacts their tax liability, ensuring accurate reporting and compliance with IRS regulations. Understanding this form is crucial for anyone involved in trading or selling capital assets, as it can directly affect tax outcomes.

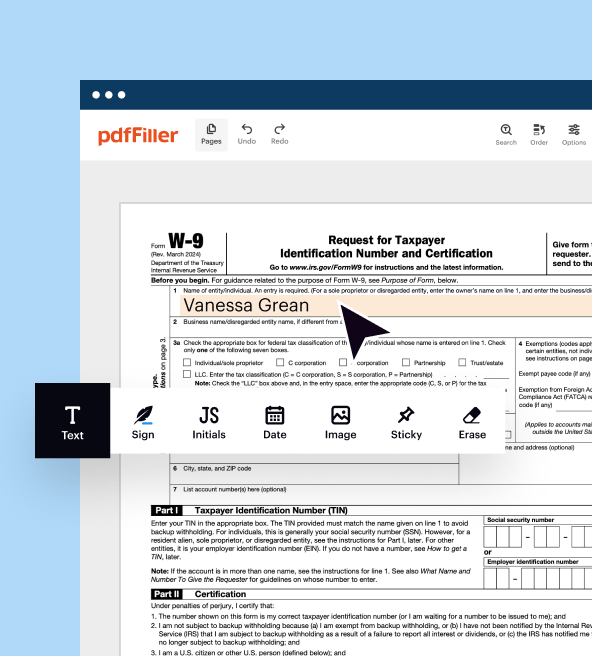

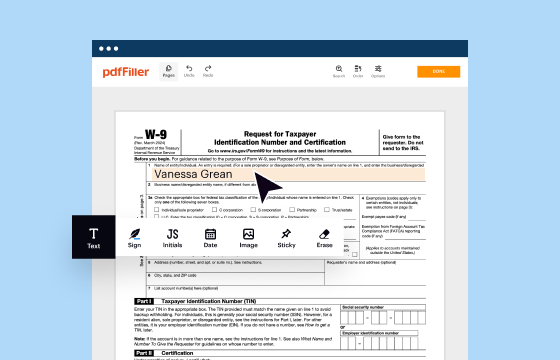

Detailed Instructions for Editing IRS Form 8949

01

Prepare by gathering all transaction records, including purchase and sale information.

02

Access Form 8949 through the IRS website or tax preparation software.

03

Identify sections for short-term and long-term transactions, marking them accordingly.

04

In the appropriate section, enter details of each transaction, including asset description, acquisition date, sale date, and proceeds.

05

Review your entries for accuracy and ensure that all transactions are accounted for.

06

Determine if adjustments for wash sales are needed and record them accordingly.

Guidelines for Completing IRS Form 8949

01

List only sales that resulted in gains or losses, omitting transactions that are exempt.

02

Provide accurate descriptions for each asset sold, such as "100 shares of XYZ Corp."

03

Include both the date acquired and the date sold for each item to help determine if it's a short- or long-term gain or loss.

04

Calculate the gain or loss by subtracting the cost basis from the proceeds of sale and document it in the appropriate column.

05

Ensure to carry totals to Schedule D, which summarizes your overall capital gains and losses.

Show more

Show less

Recent Updates and Modifications Impacting IRS Form 8949

Recent Updates and Modifications Impacting IRS Form 8949

This year, the IRS has introduced notable updates to Form 8949, particularly concerning how cryptocurrency transactions are reported and taxed. Taxpayers are now required to disclose additional information for cryptocurrency transactions, including the type of currency and whether the transaction was a result of mining or staking. Furthermore, there are heightened reporting requirements for transactions exceeding specific thresholds, necessitating closer inspection of taxpayer records.

Essential Insights About the Purpose and Utilization of IRS Form 8949

What is IRS Form 8949?

What is the Function of IRS Form 8949?

Who Needs to Fill Out This Form?

Conditions for Exemptions from Filing IRS Form 8949

What Elements Comprise IRS Form 8949?

When is the Filing Deadline for IRS Form 8949?

Comparing IRS Form 8949 with Similar Tax Forms

Types of Transactions Covered by IRS Form 8949

Number of Copies Required for Form Submission

Consequences for Failing to Submit IRS Form 8949

Information Needed for Filing IRS Form 8949

Other Forms That May Accompany IRS Form 8949

Where to Submit IRS Form 8949

Essential Insights About the Purpose and Utilization of IRS Form 8949

What is IRS Form 8949?

IRS Form 8949 is a tax form used by individuals to report capital gains and losses from the sale or exchange of capital assets. This includes various transactions such as stocks, bonds, real estate, and certain personal property disposals.

What is the Function of IRS Form 8949?

The primary function of Form 8949 is to report each transaction for calculating capital gains or losses that must ultimately be reported on Schedule D of the taxpayer’s return. This form provides a detailed breakdown, allowing the IRS to verify the taxpayer's reported gains and losses accurately.

Who Needs to Fill Out This Form?

Taxpayers engaged in the sale of capital assets like stocks or real estate must complete Form 8949. This encompasses individual investors, business owners, and anyone who has sold a capital asset within the tax year. If significant transactions occurred, even casual investors may need to file.

Conditions for Exemptions from Filing IRS Form 8949

01

Transactions where all gains are offset by losses may not require filing.

02

If the total sales of capital assets are under a certain threshold (e.g., $2,000), exemptions might apply.

03

Sales of personal-use property are generally not reported.

What Elements Comprise IRS Form 8949?

Form 8949 includes sections for short-term and long-term transactions. Key components of the form are as follows: the description of the asset, the date acquired, the date sold, proceeds, cost basis, adjustments, and the resulting gain or loss. Each of these elements is crucial for accurately calculating tax liability.

When is the Filing Deadline for IRS Form 8949?

The filing deadline for IRS Form 8949 coincides with the overall tax return due date, typically April 15 of the following year, unless extended. It’s essential for taxpayers to meet this deadline to avoid penalties.

Comparing IRS Form 8949 with Similar Tax Forms

Form 8949 often works alongside Schedule D. While Form 8949 provides the detailed transaction listings, Schedule D summarizes the overall capital gains and losses. Some taxpayers also utilize Form 4797 for business asset sales; however, the purpose is distinct, focusing on business property rather than personal capital assets.

Types of Transactions Covered by IRS Form 8949

Form 8949 explicitly covers the sale of stocks, bonds, real estate, and personal property sales that do not qualify as income. It includes gains or losses from tradable securities and real estate transactions.

Number of Copies Required for Form Submission

Typically, only one copy of IRS Form 8949 needs to be submitted with your tax return. However, if there are separate state filing requirements, additional copies may be needed.

Consequences for Failing to Submit IRS Form 8949

01

Minor penalties can include a fine of $50 for incorrect or incomplete filings.

02

More severe failures may lead to penalties of up to 20% of unreported capital gains.

03

Taxpayers may also face audits leading to increased scrutiny and potential additional liabilities.

Information Needed for Filing IRS Form 8949

When preparing to file IRS Form 8949, taxpayers should have access to sales records, buy/sell statements, brokerage records, and any related documentation to verify transactions. Accurate records retain the details essential for completing the form correctly.

Other Forms That May Accompany IRS Form 8949

Form 8949 is commonly filed alongside Schedule D, which summarizes capital gains and losses. In cases involving business property, Form 4797 may also be necessary.

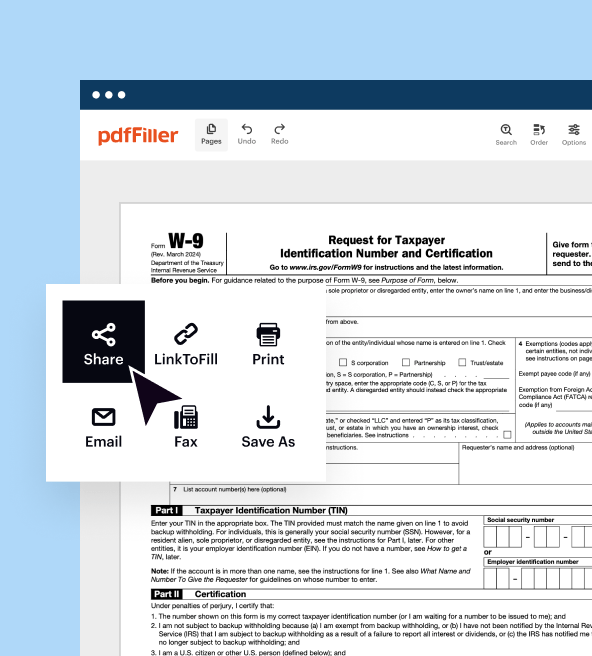

Where to Submit IRS Form 8949

IRS Form 8949 should be submitted to the IRS as part of your annual tax return. This is typically done electronically through tax software or a professional tax preparer, ensuring timely submission and possible e-filing advantages.

Understanding IRS Form 8949 is vital for compliance and effective tax planning. For detailed assistance or to streamline your tax filing process, consider reaching out to a professional tax advisor or utilizing reliable tax software to ensure accurate reporting and optimal tax outcomes.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

The forms are quick and easy to fill out! Thanks!

Just started with it but am enjoying being able to do this!

Try Risk Free