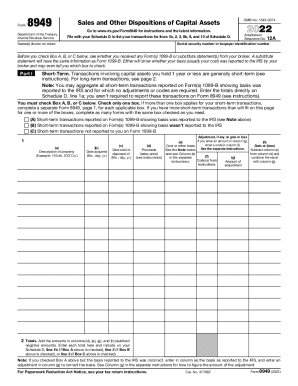

What is IRS Form 8949?

The full name of form 8949 is the Sales and Other Dispositions of Capital Assets. It is required to report sales, exchanges, and gains and losses in short- or long-term transactions involving capital assets. These include distributed and undistributed gains, partnership interest or stocks sales, losses from wash sales, profit and losses for options trading, disposition of inherited assets, etc.

Who needs an IRS Form 8949 2023?

The Internal Revenue Service issued this document in 2011 to oblige individuals, partnerships, and corporations to report short- and long-term capital gains and losses from sales or investment exchange. Previously, investment activity was reported on Schedule D.

What information do I need to file form 8949?

You need to have the filer's name as it appears on their return, their Social Security or Taxpayer Identification Number, and information about short-term (one year or less) and long-term (more than one year) transactions involving capital assets. For more detailed information, check the official form 8949 instructions by the Internal Revenue Service.

How do I fill out the 8949 Form in 2024?

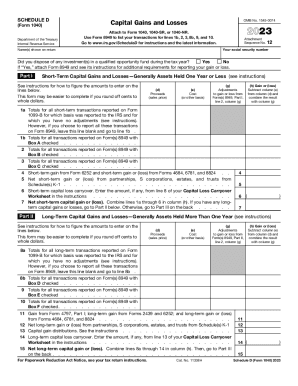

The template consists of two pages. You can print the template and fill it out manually or take advantage of a robust PDF editor and fill it online. Follow the steps below to accelerate the preparing process with pdfFiller:

- Select Get Form at the top of the page.

- Insert the filer's name as shown on their return into the first fillable fields.

- Provide a filer's Social Security Number or Taxpayer Identification Number.

- Click one of the boxes (A, B, or C) to add a checkmark. If more than one box is applicable for your case, prepare a separate record for each check-marked box.

- Fill out the table. Provide details about the property, dates of acquiring and selling it, proceeds, etc.

- Insert totals: sum amounts indicated in d, e, g, and h columns.

- Repeat the entire procedure for filling out the second page of the template with the details about your long-term transactions involving capital investments.

- Click Done to close the editor and access the document exporting menu. Download it to your device, send it by email, or print it out in two clicks.

Benefit from our easy-to-use PDF editor and prepare your tax forms more conveniently!

Is the IRS Form 8949 accompanied by other forms?

According to the new IRS requirements, a filer should submit it with 1099-B and Schedule D of the filing return. It can be Schedule D for Forms 1040, 1041, 1065,1120, 1120-S, 8282, etc.

When is the 8949 Form due?

The document must be submitted when the federal tax return is due – on Tax Day, April 15. However, if April 15 is a holiday, the deadline moves to the first working day following this date.

Where do I send IRS Form 8949?

Send the completed record to the Internal Revenue Service office along with the yearly tax return report. Check out the list of up-to-date addresses on their official website.